Guide - Uniswap

Uniswap - The leader of decentralized exchanges (DEX)

By Crypto Nation – January 2, 2021

Uniswap is the decentralized platform with the largest amount of volume in the DeFi ecosystem today. This platform is dedicated to transactions of all cryptocurrencies circulating on the Ethereum (ETH) blockchain. We can thus find a very rich offer of tokens. The platform is used with the MetaMask web wallet.

Uniswap: Pioneer of one of Ethereum's greatest successes

Contents of our guide to using Uniswap:

What is Uniswap, the power of DeFi

Launched in November 2018, Uniswap is a leading advocate for decentralization, and has become Ethereum‘s most popular automated market maker (AMM) exchange. This automated and open-source liquidity protocol allows transactions to be made between any ERC20 token (based on Ethereum).

On the other hand, the platform allows everyone to become a Liquidity Provider (LP) for the exchange pair of their choice, and to be remunerated accordingly.

How to trade on Uniswap

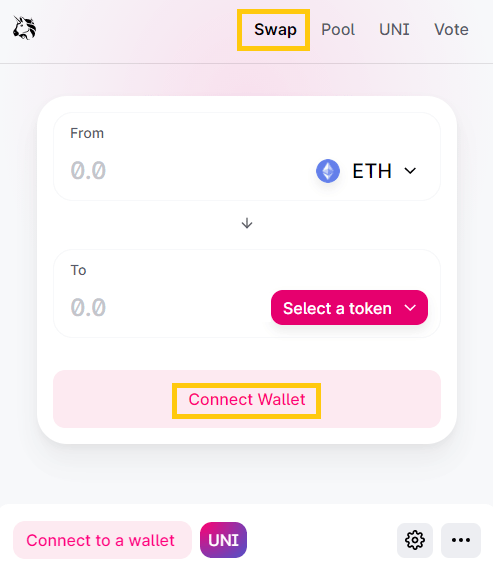

Go to the dedicated Uniswap page by clicking here.

First, you ideally need a MetaMask wallet, and connect it with Uniswap. However, there are other possible connections:

- WalletConnect

- Coinbase Wallet

- Fortmatic

- Portis

Once the link has been made, the various tokens present in your wallet will be directly exchangeable!

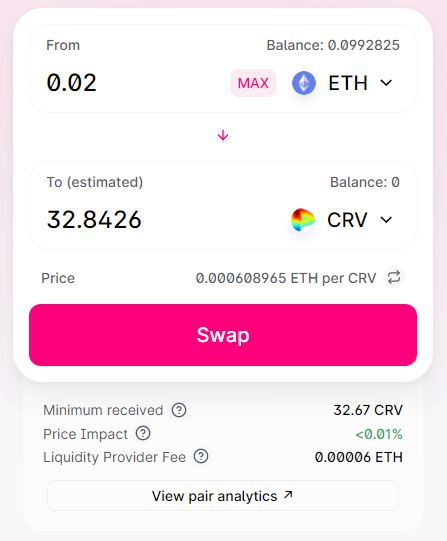

The Swap is an exchange of one cryptocurrency for another, between two ERC20 tokens directly. You just have to find the cryptocurrency of your choice in the list, and indicate the desired quantity, in order to be able to proceed to an exchange.

In our example, we are about to swap 0.02 Ethereum (ETH) against around 33 Curve (CRV). Uniswap tells us the price of the pair directly as well as the costs of the initial transaction.

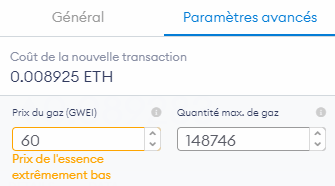

The transaction fees are 0.3% on Uniswap. They are paid in full to the liquidity providers. In addition, there are transaction fees for the Ethereum network, called gas. The price of Ethereum gas fluctuates daily based on demand. The more people who want to use Ethereum at the same time, the more the price of gas increases. If the fees are too high for you, try again later hoping the blockchain is quieter.

Also, the higher the cost of fees you choose, the faster the transaction will be. Be careful not to specify a custom gas setting that is too low, otherwise your transaction may fail.

So avoid swapping too small amounts, otherwise the fees may be higher than the total amount of your assets!

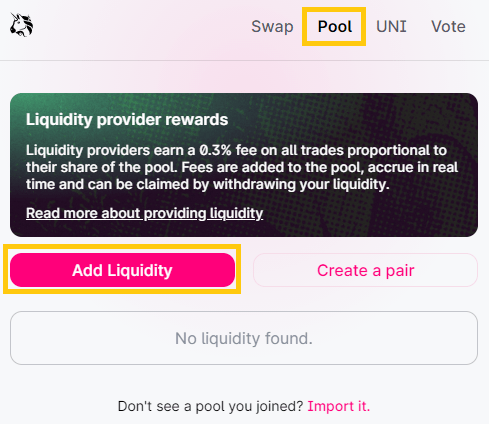

Become a liquidity provider

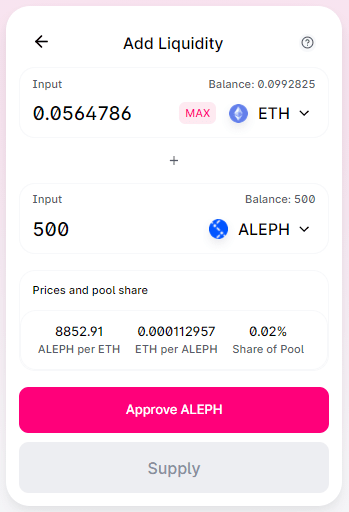

Go to the Pool tab of Uniswap. Click on the Add Liquidity button, then indicate the token pair and the quantity you want to add to the liquidity pool. Then confirm your transaction, and your tokens will be transferred to the pool.

In our example, we add liquidity to the ETH / ALEPH pool. Our capital will represent 0.02% of the cash in this pool.

You will be automatically remunerated through transaction fees, based on the percentage of the liquidity pool you hold.

The governance of Uniswap

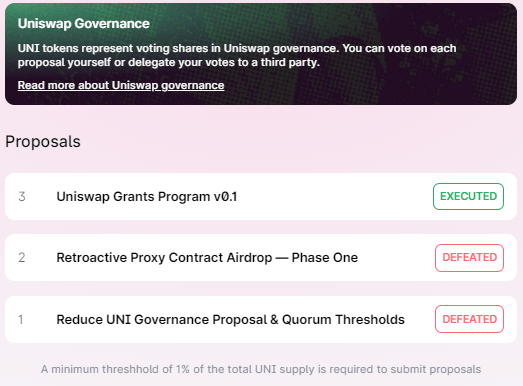

Holders of UNI tokens, the Uniswap token, can vote on the Uniswap ecosystem. Thus, the community obtains a right of governance making it possible to decide on the evolution of the platform.

To do this, simply go to the Vote tab.

View market information

By going to the last tab, named Charts, you will find all the information available to the Uniswap platform.

- The Uniswap Global View.

- Tokens.

- The pairs.

- The transactions.

- The portfolio analyzer.

Uniswap is a revolutionary platform, which seems limitless, for ERC20 tokens at least. This project will undoubtedly dominate the DeFi ecosystem for a long time, and could quickly democratize, given its ease of use, and its very long list of available cryptocurrencies.