Zoom on Japanese Candlesticks

Zoom - Japanese Candlesticks

By Crypto Nation – 06 December 2020

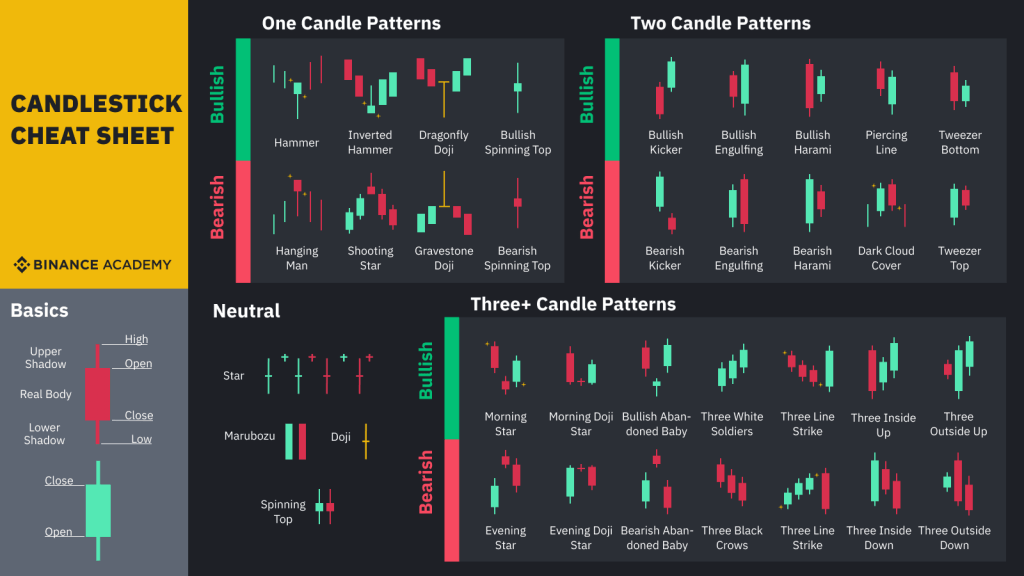

Japanese Candlesticks are the most common form of price display in trading. They are composed of a body, and wicks.

By default, a green candle indicates a price increase. Conversely, a red candle results in a drop of the price.

This display format is the most complete, because a single candle gives us 4 pieces of information :

- The opening price.

- The highest price reached.

- Conversely, the lowest price reached.

- And the closing price.

Japanese candlesticks are used in Technical Analysis (TA) of a market to represent price changes. Technical analysis over a past period is supposed to give indications on the future direction of the market or a price.

We then distinguish several types of Japanese candlestick figures, the most common being:

- Marubozu: Indicates a strong impulse.

- Its body is full.

- it has no, or very small wicks.

- It can be bullish or bearish.

- Doji: Sign of hesitation.

- it has no body.

- its wicks are long.

- There are several types of Dojis, but are always hesitant.

- Spinning Top: Sign of hesitation.

- Almost no body.

- The wicks are long.

- Similar translation to Dojis, we see hesitation.

- Hammer: Translates into a sign of bullish impulse.

- Defined by a small bullish body.

- With a long wick down, without wick up.

- Can also be compared to a rocket.

- Shooting Star: Irregular pulse sign.

- Has a small bearish body.

- With a long wick upwards, and without a low wick.

Explanatory video

Below, you’ll find a detailed video on the technical analysis of Japanese candlesticks, made by our partner Zone9. This content is in French.